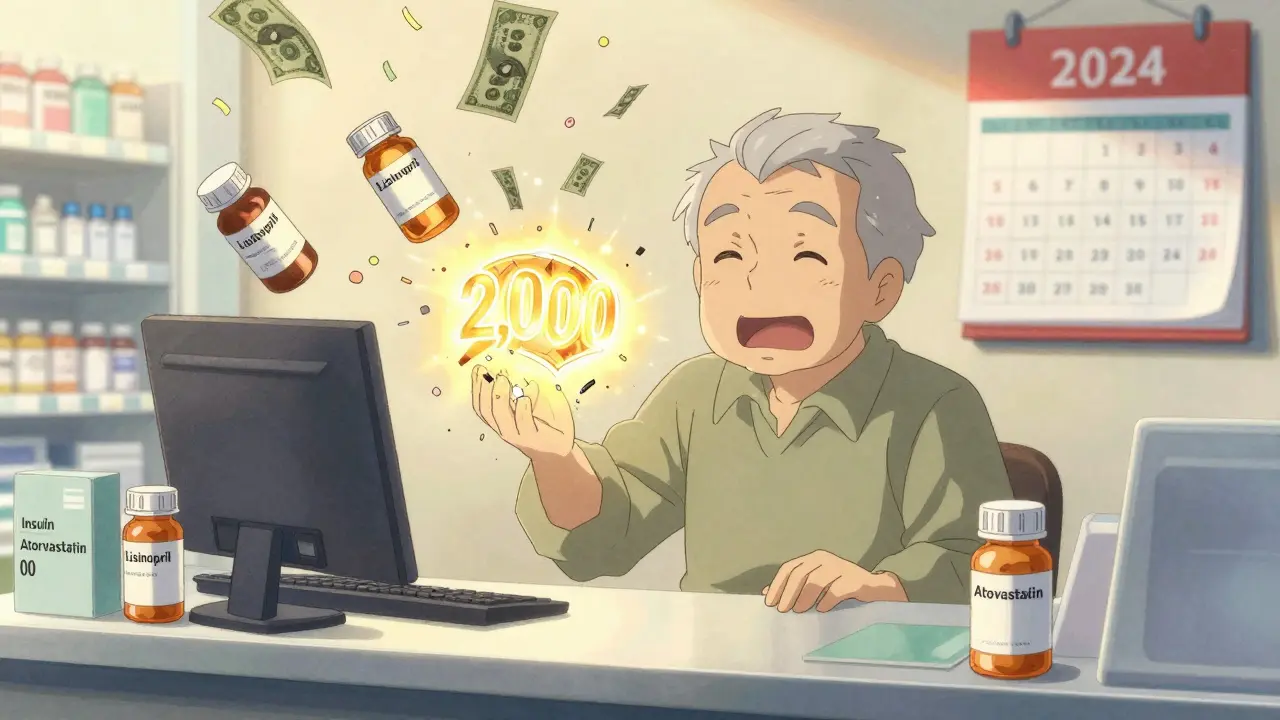

Starting in 2025, Medicare drug coverage changed in ways that could save you thousands of dollars a year-if you know where to look. For millions of seniors on fixed incomes, the old system of jumping through hoops to pay for insulin, heart meds, or cancer drugs is gone. The Medicare Part D out-of-pocket cap is now $2,000 per year, and the dreaded "donut hole" has vanished entirely. This isn’t a minor tweak. It’s the biggest shift in prescription drug help since Medicare Part D began in 2006.

What Changed in Medicare Part D for 2025?

Before 2025, your drug costs had three parts: a deductible, then your share during initial coverage, then a gap (the donut hole) where you paid more, and finally catastrophic coverage after spending a lot. That gap used to mean paying up to 25% of drug costs even after you’d already spent thousands. In 2023, the cap hit $7,400. Now? You stop paying after $2,000-no matter how many pills you need.

Here’s how it works now:

- You pay a deductible (up to $590 in 2025; some plans have none).

- After that, you pay 25% of drug costs. The plan pays 65%, and drugmakers chip in 10%.

- Once you’ve spent $2,000 out of your own pocket (including deductible and copays), you hit catastrophic coverage.

- From there, you pay $0 for covered drugs for the rest of the year.

Only what you pay out of pocket counts toward that $2,000. Monthly premiums? They don’t. Drugs not on your plan’s list? Those don’t count either. But every copay, every coinsurance payment, every dollar you hand over at the pharmacy? That adds up.

How Much Could You Save?

If you take multiple prescriptions-especially expensive ones-you’re looking at big savings. Take insulin. Thanks to the Inflation Reduction Act, you pay no more than $35 for a 30-day supply of any insulin covered under Part D. For someone on three types of insulin, that’s over $1,150 saved a year.

One woman in Florida, on a cancer drug that cost $1,200 a month, spent $6,800 out of pocket in 2024. In 2025? Her total drug spending is capped at $2,000. That’s $4,800 saved in one year.

Even if you don’t take expensive drugs, the cap helps. Say you take five generic meds totaling $1,500 a year. Before 2025, you might have paid $500-$700 out of pocket. Now, you’ll likely pay under $400-and if you hit the cap early, you pay nothing else for the year.

What About the Extra Help Program?

If your income is low, you might qualify for Extra Help-a federal program that pays for your Part D premiums, deductibles, and copays. About 14.5 million people get it. In 2025, you’re eligible if you earn up to $21,870 as a single person or $29,520 as a couple, and have assets under $17,220 (or $34,360 for a couple).

Extra Help doesn’t just lower your monthly bill. It also reduces your out-of-pocket spending before you hit the $2,000 cap. That means you reach catastrophic coverage faster-or never even reach it.

Many people don’t apply because they think they make too much. But the income limits are higher than you’d expect. If you get Medicaid, SNAP, or SSI, you’re automatically enrolled. Even if you don’t, you can apply online at SSA.gov or through your local State Health Insurance Assistance Program (SHIP).

Plan Choices Are Shrinking-But You Have Options

In 2025, the average Medicare beneficiary has 48 drug plans to choose from: 14 stand-alone Part D plans (PDPs) and 34 Medicare Advantage plans that include drug coverage (MA-PDs). That’s down from 52 plans in 2024. The number of stand-alone plans has dropped 52% since 2015. Why? Big insurers are merging plans and pushing people into Medicare Advantage.

That’s not always bad. MA-PDs bundle doctor visits, hospital care, and drugs into one plan. They often have lower premiums and extra perks like dental or transportation. But they also lock you into a network. If your favorite pharmacy isn’t in-network, you’ll pay more-or have to switch.

Top insurers now control most of the market: UnitedHealthcare, Humana, CVS Health-Aetna, Cigna, and WellCare cover 78% of Part D enrollees. That means fewer choices, but more consistency in how plans are designed.

How to Pick the Right Plan

Don’t just renew automatically. Eighty-three percent of people do-and most end up paying more than they need to.

Here’s what to do:

- Make a list of every drug you take, including dose and how often.

- Go to Medicare.gov and use the Medicare Plan Finder. Enter your drugs, zip code, and pharmacy.

- Sort by "Total Drug Cost"-not just premium. That shows what you’ll pay for your meds plus the plan fee.

- Check if your pharmacy is in-network. CVS, Walgreens, and Walmart are common, but not all plans include them.

- Look for plans that cover your drugs without prior authorization or step therapy.

For example, if you take metformin, lisinopril, and atorvastatin, a plan with low copays on generics might be cheaper than one with a $0 premium but high drug costs. Don’t assume the cheapest premium is the best deal.

When and How to Switch

You can only change plans during the Annual Enrollment Period: October 15 to December 7. Changes take effect January 1. If you miss it, you’re stuck until next year-unless you qualify for a Special Enrollment Period.

Qualifying events include moving out of your plan’s service area, losing other drug coverage, or getting Extra Help. If you’re in a nursing home or qualify for Medicaid, you can switch anytime.

Need help? Call 1-800-MEDICARE or find your local SHIP counselor. There are over 13,500 free counseling sites nationwide. They don’t push plans-they just help you understand your options.

What Doesn’t Count Toward the ,000 Cap?

Not everything you pay counts. Premiums? No. Drugs your plan doesn’t cover? No. Buying drugs outside your plan’s network? No. Even if you pay cash for a drug that’s not on your formulary, it won’t help you reach the cap.

Also, if you get a drug from a manufacturer’s discount program (like a $10 coupon), that discount doesn’t count toward your out-of-pocket total. Only what you pay directly to the pharmacy counts.

That’s why it’s so important to use your plan’s pharmacy. If you switch to a non-network pharmacy for a better price, you might save money short-term-but you won’t get closer to your $2,000 cap.

What’s Coming in 2026?

The $2,000 cap will rise slightly to $2,100 in 2026 due to inflation. But the structure stays the same: no donut hole, no unlimited spending. CMS plans to upgrade the Plan Finder tool in late 2025 to show estimated yearly costs for each plan based on your exact drugs. That should make comparisons even easier.

Experts expect fewer stand-alone Part D plans in the future. By 2027, you might only have 10 options per region. That means more people will move into Medicare Advantage plans with drug coverage. It’s not bad-just something to plan for.

Bottom Line: You’re Not Alone

Medicare drug coverage used to be confusing, unpredictable, and expensive. Now, it’s simpler. If you’re spending over $2,000 a year on meds, you’re protected. If you’re on a tight budget, Extra Help could cut your costs even further. And if you’re unsure? Get free help. Don’t guess. Don’t assume. Use the tools. Ask questions. The system is designed to help you now-just make sure you’re using it right.

Does the $2,000 cap include my monthly premium?

No, your monthly premium does not count toward the $2,000 out-of-pocket cap. Only what you pay at the pharmacy for your prescriptions-like deductibles, copayments, and coinsurance-counts. You still have to pay your premium every month, even after you hit the cap.

Can I use Extra Help with any Part D plan?

Yes, Extra Help works with any Medicare Part D plan, whether it’s a stand-alone drug plan or a Medicare Advantage plan with drug coverage. The program pays part or all of your premium, deductible, and copayments. You don’t need to switch plans to get it-just apply.

What if my drug isn’t on my plan’s formulary?

If your drug isn’t covered, you can ask your plan for an exception. Your doctor can submit a request saying the drug is medically necessary. If denied, you can appeal. You can also switch plans during the next enrollment period or use a Special Enrollment Period if you qualify.

Is the $35 insulin cap really $35 for everyone?

Yes, for any insulin covered under Part D or Part B, you pay no more than $35 for a 30-day supply. This applies to all types of insulin-long-acting, rapid-acting, or mixed. It doesn’t matter what plan you’re on or your income. The cap is built into the law.

Can I switch plans mid-year if my drug costs go up?

Generally, no. You can only change plans during the Annual Enrollment Period (October 15-December 7) unless you qualify for a Special Enrollment Period. Examples include moving out of your plan’s service area, losing other coverage, or becoming eligible for Extra Help. If your drug gets taken off the formulary, you can switch right away.

Buy Cialis Professional Online: Your Guide to Secure Purchase

Buy Cialis Professional Online: Your Guide to Secure Purchase

What Is Medication Adherence vs. Compliance and Why It Matters

What Is Medication Adherence vs. Compliance and Why It Matters

What to Do If a Child Swallows the Wrong Medication: Immediate Steps That Save Lives

What to Do If a Child Swallows the Wrong Medication: Immediate Steps That Save Lives

IP-6: The Dietary Supplement That's Taking the Health World by Storm

IP-6: The Dietary Supplement That's Taking the Health World by Storm

Feverfew and Anticoagulants: What You Need to Know About Bleeding Risk

Feverfew and Anticoagulants: What You Need to Know About Bleeding Risk