Pharmacy Benefits: What You Really Get from Your Medication Coverage

When you hear pharmacy benefits, the system that controls which drugs your insurance covers and how much you pay for them. Also known as prescription drug coverage, it’s not just about getting meds—it’s about knowing what’s actually in your plan and how to use it without getting hit with surprise costs. Most people think their pharmacy benefits mean they can walk into any pharmacy and get their pills cheap. But that’s not always true. Your plan might cover generic drugs, lower-cost versions of brand-name medicines approved by the FDA but not the brand. Or it might require you to try cheaper options first—called step therapy—before approving the one your doctor picked. This isn’t bureaucracy for the sake of it; it’s how insurers control costs, and you need to know how to work within it.

Pharmacy benefits also tie into drug interactions, when two or more medications affect each other’s safety or effectiveness. If your plan covers a drug that clashes with another you’re taking, you might not even know until it’s too late. That’s why checking your formulary—your plan’s list of approved drugs—isn’t just paperwork. It’s a safety step. You’ll find posts here that show how proton pump inhibitors, common stomach acid reducers can mess with antifungal absorption, or how L-tryptophan, a supplement some take for mood can dangerously overlap with antidepressants. If your pharmacy benefits don’t flag these risks, you’re on your own. And that’s where knowing your coverage becomes lifesaving.

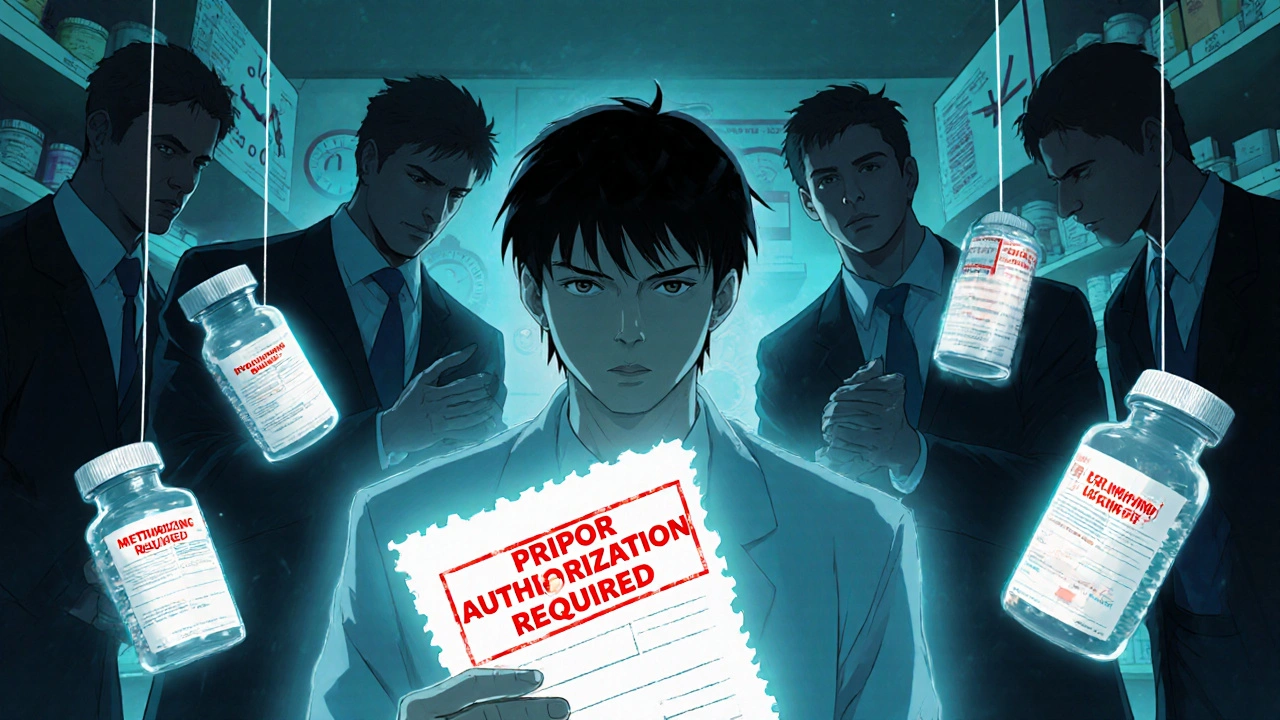

Then there’s the cost. Pharmacy benefits often hide fees behind tiers, copays, and prior authorizations. You might think you’re getting a deal on generic amoxicillin, an affordable antibiotic online, but if your plan doesn’t cover that pharmacy, you pay full price. Or you might be paying more for Rhinocort, a nasal steroid spray for allergies because your plan pushes you toward a cheaper alternative that doesn’t work for you. The posts below break down real examples: why authorized generics look different but work the same, how evergreening, a tactic drug companies use to delay generics keeps prices high, and how to spot when you’re being overcharged for something that should be cheap. You’ll see how medication adherence, taking your drugs as prescribed ties directly to your benefits—skipping doses because you can’t afford them isn’t just bad for your health, it can cost you more in the long run.

What you’ll find here isn’t theory. It’s what people actually deal with: choosing between Tadalista, a tadalafil-based ED drug and its competitors because one’s covered and the other isn’t; comparing Adalat, a blood pressure med to cheaper alternatives; or figuring out if Female Cialis, a treatment for low sexual arousal in women is even worth asking for. These aren’t random articles—they’re answers to the real questions you’re asking when your pharmacy benefits feel like a maze. You’ll learn how to read your formulary, challenge denials, and find affordable options without risking your health. No fluff. Just what you need to get the right meds at the right price.