Patent Extension: What It Means for Drug Prices and Access

When a drug company gets a patent extension, a legal delay that pushes back when generic versions can enter the market. Also known as market exclusivity extension, it’s a tool used by pharmaceutical companies to protect profits after the original 20-year patent runs out. This isn’t just a paperwork tweak—it directly affects whether you pay $10 or $500 for the same pill.

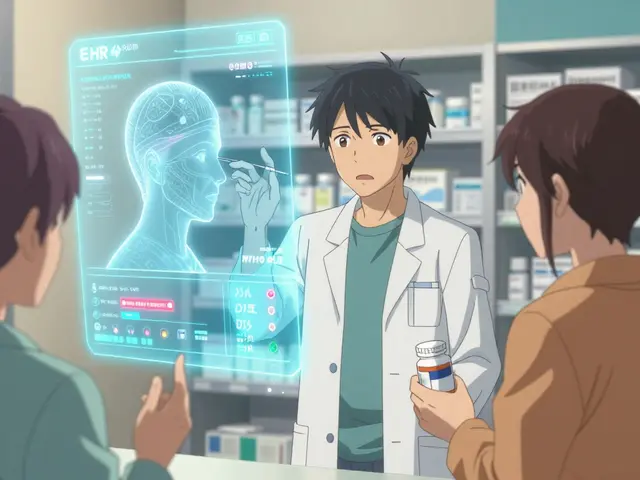

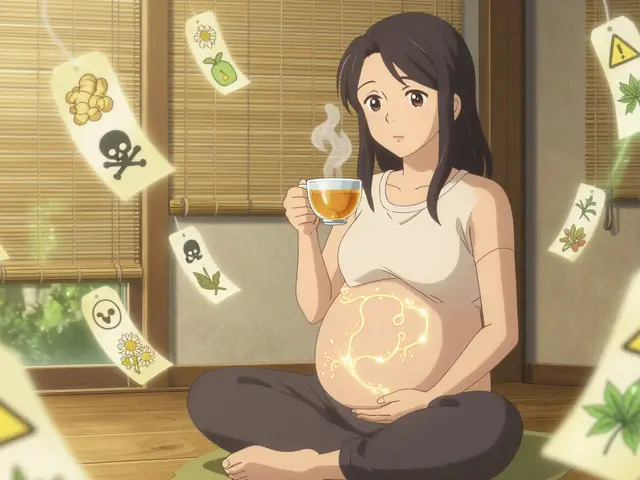

Patent extensions often happen because of regulatory review delays, the time the FDA takes to approve a new drug before it can even be sold. The law gives companies extra time to make up for those lost months. But sometimes, companies file for extensions based on minor changes—like a new pill shape or a slightly different dosage—not because the drug is better, just because they want to keep competitors out. This is where generic drugs, chemically identical versions of brand-name meds that cost far less get stuck waiting. You might see ads for a new "improved" version of a drug, but the real reason it’s priced high isn’t innovation—it’s patent extension.

It’s not just about big pharma. These extensions ripple through the system. Insurance companies pay more. Pharmacies stock fewer generics. Patients delay refills because they can’t afford the brand. In the U.S., a single patent extension can cost the healthcare system billions over a few years. Meanwhile, countries like Canada and the UK limit these extensions to keep prices down. The patent extension isn’t just a legal term—it’s a financial lever that controls who gets treated and who doesn’t.

Below, you’ll find real examples of how patent extension affects everyday medications—from blood pressure pills to ED drugs—and how it connects to things like prior authorization, generic appearance, and drug pricing tricks you might not even notice. These aren’t theoretical debates. They’re the reason your prescription costs more than it should.