Formulary Restrictions: What They Are and How They Affect Your Medications

When your insurance company decides which drugs they’ll pay for, they’re using a formulary, a list of approved medications covered under a health plan. Also known as a drug list, it’s not just a catalog—it’s a gatekeeper that can stop you from getting the medicine your doctor recommends. These lists aren’t random. They’re built by pharmacy benefit managers (PBMs) and insurance plans to control costs, but they often block cheaper generics, require prior authorization, or force you to try other drugs first. That’s what we call formulary restrictions, rules that limit access to certain medications based on cost, policy, or clinical guidelines. You might not see them coming, but they’re behind every denied claim, every phone call to your doctor for prior auth, and every time you’re told, "We can cover this, but only if you try X first."

These restrictions don’t just affect expensive brand-name drugs. They hit generics too. A drug might be on the formulary, but only if you use a specific manufacturer’s version. That’s why you might get a different-looking pill than last month—even if it’s the exact same active ingredient. This happens because of tiered formularies, a system that groups drugs into cost levels, with lower tiers having lower patient costs. Tier 1 might be your $4 generic, while Tier 3 could be a brand-name drug that costs $300. If your doctor prescribes something in Tier 4 or 5, your insurer might refuse to pay unless you prove it’s medically necessary. And that’s where prior authorization, a process requiring doctor approval before a drug is covered. comes in. It’s not just paperwork—it’s a delay that can mean weeks without your meds.

Some drugs are outright excluded. Ever wonder why certain antibiotics, painkillers, or even mental health meds aren’t covered at all? That’s because they’re on the negative formulary, a list of drugs that are completely excluded from coverage. These are often older drugs with better alternatives, or ones with high abuse potential. But sometimes, the exclusion is just about profit margins. If a drug has no generic competition, insurers might not want to cover it unless you jump through hoops. And if you’re on Medicare Part D or a private plan, these rules change every year. What was covered last January might be off-limits this July.

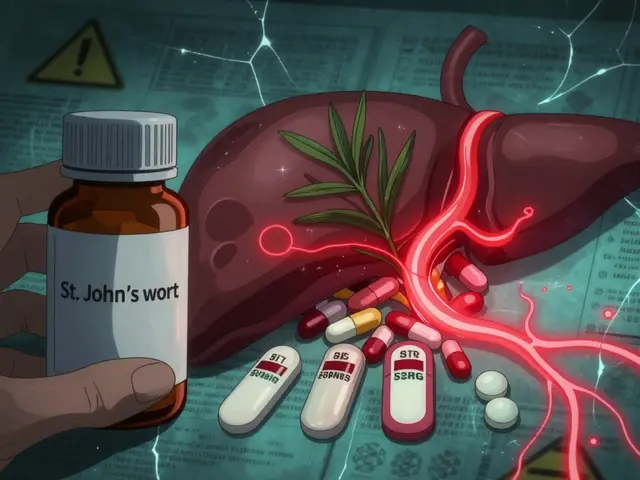

These restrictions don’t exist in a vacuum. They’re tied to real-world outcomes. A 2023 study showed patients who faced formulary barriers were 35% more likely to skip doses or stop taking meds altogether. That’s not just inconvenient—it’s dangerous. Whether it’s your blood pressure pill, your insulin, or your antidepressant, if you can’t get it reliably, your health suffers. That’s why knowing how to navigate these rules matters. You’re not just a patient—you’re a consumer with rights. You can ask for a formulary exception, appeal a denial, or switch to a plan with better coverage during open enrollment. The posts below show you exactly how this plays out in real cases: from why your antifungal got denied because of a PPI interaction, to how authorized generics look different but work the same, to how evergreening keeps prices high by blocking generics. These aren’t abstract policies. They’re the hidden forces shaping your daily health choices. What you’ll find here are the real stories behind the rules—and how to fight back when they work against you.